How Shankar Sharma’s Family Built Wealth Without Stocks or Mutual Funds

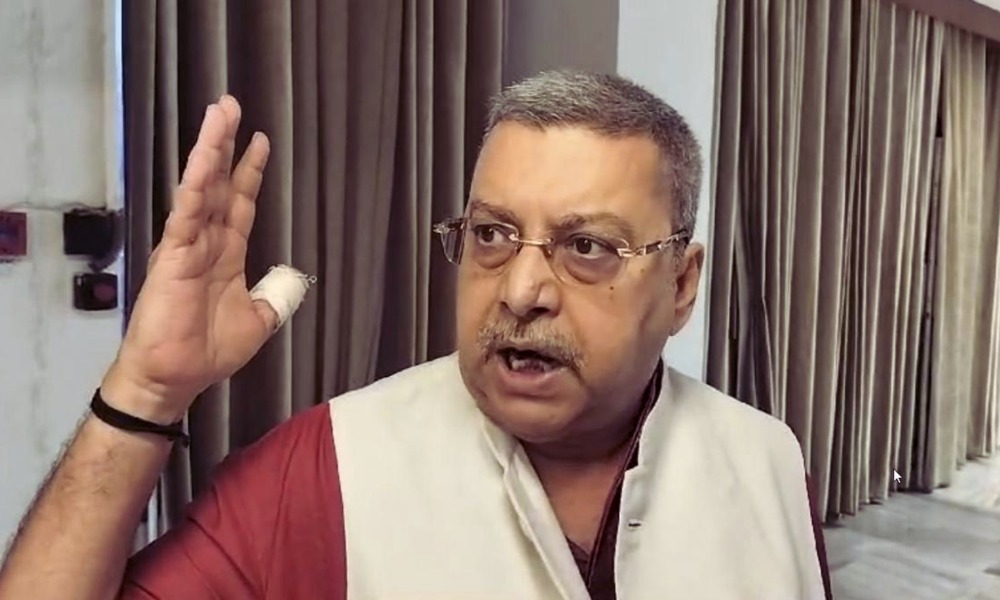

Veteran investor Shankar Sharma recently shared how his sister and brother-in-law achieved financial success without relying on stocks or mutual funds.

Sharma revealed that for the past 35 years, his sister and brother-in-law, who live in a small town, have been asking him for investment advice.

However, rather than directing them toward the stock market, Sharma consistently advised them to stay away from it.

“My sister and brother-in-law live in a small town. Have pestered me for 35 years, ‘Tell us where/how to invest in stocks/MFs.’ My standard reply: ‘Stay away. This isn’t for folks like y’all. Put 40% in good FDs, 30% in gold, 30% in raw land 25 km out of town,’” Sharma wrote in a post on X (formerly Twitter).

Stress-Free and Wealthy

Sharma’s advice focused on a conservative investment strategy, emphasizing stability over high-risk market gains. He recommended allocating 40% of their funds in fixed deposits (FDs), 30% in gold, and the remaining 30% in raw land located 25 kilometers outside of town.

According to Sharma, this approach allowed his sister and brother-in-law to remain financially secure and stress-free without being affected by market volatility, interest rate changes, or global economic shifts.

“Today, they are stress-free, liquid, and wealthy beyond dreams,” Sharma stated, highlighting how they achieved financial security without needing to understand market trends, the Reserve Bank of India’s (RBI) policies, the US Federal Reserve’s decisions, or global trade wars.

Market Decline and Investment Challenges

Sharma’s advice came at a time when mutual fund inflows have been under pressure. In February, net equity inflows dropped to ₹29,241.78 crore—a 26.29% decrease from January’s ₹39,669.6 crore.

Overall mutual fund inflows also saw a sharp 79% decline in February, mirroring a 5% drop in the Nifty 50 and BSE Sensex indices.

Sharma recently commented on the challenges faced by new investors, particularly those reducing their systematic investment plans (SIPs) due to market losses.

Speaking to Business Today Executive Director Rahul Kanwal, Sharma remarked, “Stock markets—this is the way the game works. Like I said earlier, let them also suffer what we have suffered over 35 years.”

India’s Domestic Market Challenges

In a separate post, Sharma argued that the current bear market in India is a local issue, not linked to global trends.

He explained that while past market downturns—like the 1992 Harshad Mehta scam, the 2000 dot-com crash, the 2008 global financial crisis, and the 2020 COVID crash—were part of broader global economic shifts, India’s current market problems are more localized and will require domestic solutions.

The Role of Luck in Market Success

When a user on X suggested that stock trading could also generate significant wealth, Sharma acknowledged that luck plays a crucial role in market success.

He noted that only a small group of people—fewer than 50 to 70 individuals over the past 35 years—had managed to make serious money through stock trading. “We were lucky, that’s all,” he admitted.

Sharma highlighted the difficulty of sustaining long-term success in the stock market. “Let nobody tell you otherwise. It’s very, very difficult to bat for decades, on different pitches, and survive. And it requires a big bull market tailwind too,” he wrote.

Debate Over Sharma’s Advice

Sharma’s advice has sparked a debate among investors. While some praised his conservative approach, others argued that calculated risks in the stock market can lead to substantial returns.

Despite the mixed reactions, Sharma’s sister and brother-in-law’s financial success stands as a testament to the power of stable, low-risk investments.