How Nithin Kamath’s $2 Billion Lesson on Customer Loyalty Inspired a Bengaluru Techie

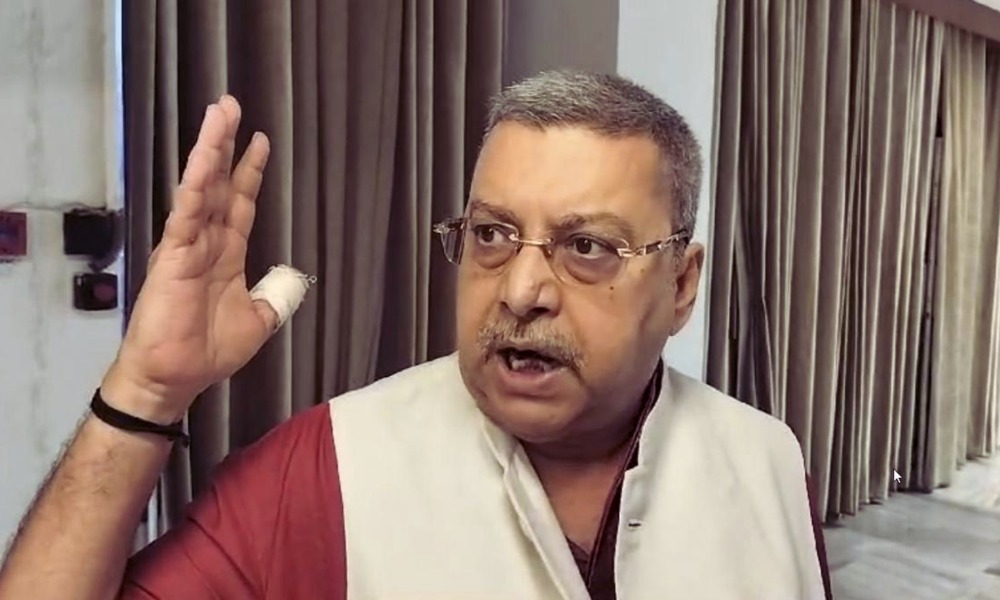

A Bengaluru-based techie recently shared how a simple email exchange with Zerodha’s CEO, Nithin Kamath, became a $2 billion lesson in customer obsession and trust.

Nithin Kamath’s swift response to a compliance-related issue not only impressed the techie but also highlighted why Zerodha stands out in customer service.

Forced to Close Zerodha Account Due to Compliance

Sachin Jha, a Product Marketing Manager from Bengaluru, faced a difficult situation when his wife joined a global investment bank. As part of the bank’s compliance requirements, Jha was asked to close his Zerodha account.

The reason was simple yet concerning: Zerodha lacked a physical bank tag, which raised internal red flags at the investment bank.

Jha shared his experience on LinkedIn, writing, “Close all Zerodha accounts. They’re not a ‘trusted broker.’ The issue? Zerodha didn’t have a physical bank tag and that was enough to trigger internal red flags.” Despite the mandate, Jha wasn’t ready to give up without trying to resolve the issue.

Taking a Chance on an Email

Jha admired Zerodha’s seamless user interface and overall experience. He decided to reach out to Nithin Kamath directly, even though he didn’t expect a response.

“As a PMM nerd, I loved their seamless UI. So I took a wild chance: Emailed CEO Nithin Kamath, expecting silence,” he wrote.

To Jha’s surprise, Kamath replied within just 10 minutes. But it wasn’t just a polite acknowledgment—it was a game-changing moment that taught Jha a valuable lesson about customer obsession.

A $2 Billion Lesson in Customer Obsession

Kamath’s response was not only quick but also strategic. He and his team immediately addressed the compliance gap and took proactive steps to fix it. They:

- Acknowledged the compliance gap with banks and promised to resolve it.

- Asked for details about Jha’s wife’s employer to explore a direct compliance partnership.

- Shared a plan to build institutional trust moving forward.

“I still closed my account,” Jha admitted, “but they won my trust for life.” This response demonstrated that Zerodha viewed customer feedback as a valuable resource and was committed to improving based on it.

Zerodha’s Digital-Only Model and the Trust Challenge

Zerodha’s digital-only model has been a key factor in its growth, allowing it to scale efficiently and maintain low operational costs. However, the lack of a physical presence has also presented challenges, especially when it comes to institutional trust.

Traditional brokers like ICICI and Kotak have the advantage of physical branches, which provide an added layer of credibility.

Kamath has publicly acknowledged this challenge, stating that while digital services work well for trading and small-value services, a physical presence is still crucial for broader financial advice and lending.

Despite these challenges, Kamath has made it clear that Zerodha is not pursuing a banking license anytime soon due to the associated regulatory risks.

Instead, Zerodha is focusing on strengthening its partnerships with platforms like Smallcase and improving operational efficiency.

Kamath’s Response Strengthens Customer Trust

Jha’s LinkedIn post highlighted the significance of Kamath’s quick and thoughtful response. Kamath not only addressed the compliance issue but also made Jha feel heard and valued as a customer.

In his LinkedIn post, Jha shared Kamath’s email response:

“Thanks for reaching out, I am looping @Salman Quaraishi from our sales team. Can you let us know where you work? We can reach out to your company. We are now empanelled with a couple of larger banks.”

This response demonstrated Zerodha’s commitment to improving its customer experience. Jha noted that Zerodha treats customer feedback as an opportunity for improvement rather than a problem.

Why Zerodha’s Approach Works

Jha’s experience underscores why Zerodha has been able to build a loyal customer base despite the absence of a physical presence.

Zerodha’s ability to adapt to customer needs and address gaps proactively has helped it maintain trust and grow its market position.

Jha concluded his post by noting that Zerodha’s success stems from its customer-first approach rather than following industry standards.

This flexibility and willingness to adapt have set Zerodha apart from traditional brokers and solidified its position as a leader in the market.