Reliance Industries Acquires Nauyaan Tradings for ₹1 Lakh in Strategic Move

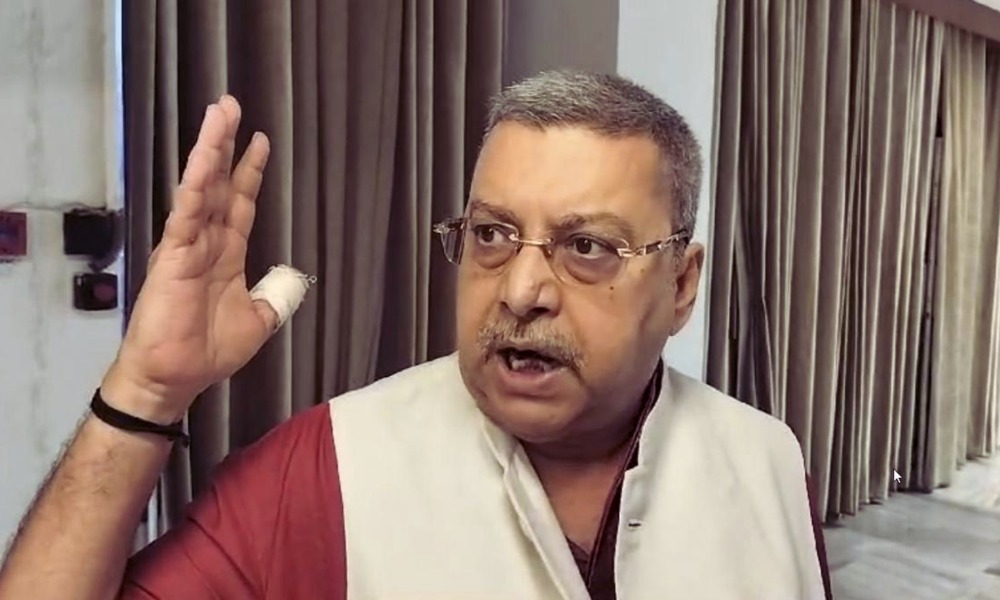

Mukesh Ambani-led Reliance Industries Limited (RIL) announced a new investment and acquisition through its wholly owned subsidiary, Reliance Strategic Business Ventures Limited (RSBVL).

On Thursday, RIL informed that RSBVL has acquired a 100% equity stake in Nauyaan Tradings Private Limited (NTPL) for ₹1 lakh from Welspun Tradings, a subsidiary of Welspun Corp. This acquisition makes NTPL a step-down wholly owned subsidiary of RIL, effective from March 20.

Acquisition of Nauyaan Tradings and Nauyaan Shipyard

NTPL, incorporated on March 3, has not yet started business operations. After the takeover by RSBVL, NTPL signed a share purchase agreement with Welspun Corp to acquire a 74% equity stake in Nauyaan Shipyard Private Limited (NSPL) for ₹382.73 crore.

NSPL’s total enterprise value stands at ₹643.78 crore, which includes debt and liabilities amounting to ₹126.57 crore. The 100% equity value of NSPL is estimated at ₹517.21 crore.

As part of the deal, NSPL will repay ₹93.66 crore to Welspun Corp. The acquisition of NSPL’s 74% stake is expected to be finalized by March 21, 2025. With this acquisition, Nauyaan Shipyard becomes a step-down subsidiary of RIL.

Details of Nauyaan Shipyard’s Business and Location

Nauyaan Shipyard was incorporated on July 15, 2021. It holds a leasehold interest in approximately 138 acres of land near RIL’s Dahej manufacturing plant in Gujarat.

The company also has rights to use foreshore land in the area. This land will be used for various industrial activities, including salt handling, storage, brine preparation, and engineering fabrication of structures. Additionally, NSPL will engage in the manufacturing of hydrogen electrolysers.

NSPL recorded no revenue in its first two years of operation. However, in the financial year 2023–24, it reported a revenue of ₹7 lakh.

Reliance’s Expansion in the Shipyard Sector

RIL has been expanding its shipyard operations in recent years. In January, Reliance Naval and Engineering Limited was renamed Swan Defence and Heavy Industries Limited after being acquired by Swan Energy Ltd.

Swan Energy plans to increase the shipyard’s manufacturing capacity, positioning India among the top five countries for heavy fabrication in the naval, defense, and oil and gas sectors.

Stock Market Activity and RIL’s Share Price Performance

On Monday, 14.5 lakh shares of Reliance Industries were traded in a block deal. The names of the parties involved have not been disclosed. In February, Tarish Investment and Trading Company sold 5,70,844 shares of RIL in a block deal at ₹1,223.95 per share.

On Thursday, Reliance shares closed 1.67% higher at ₹1,268.55 on the BSE. Over the last week, RIL’s stock has gained 1.70%, climbing nearly 5% over two weeks. Since the beginning of 2025, Reliance shares have risen by almost 4%.

RIL’s market capitalization currently stands at ₹17,16,649.16 crore.

Strong Financial Performance in Q3

Reliance Industries reported a consolidated net profit of ₹18,540 crore for the third quarter of the financial year, reflecting a 7% year-on-year increase from ₹17,265 crore in the same period last year.

Consolidated revenue rose 6.7% year-on-year to ₹2.40 lakh crore from ₹2.25 lakh crore in Q3FY24.

Earnings before interest, tax, depreciation, and amortization (EBITDA) increased by 7.7% to ₹43,789 crore from ₹40,656 crore in the previous year. The EBITDA margin improved to 18.3% from 18.1%.

RIL’s oil-to-chemicals (O2C) business contributed revenue of ₹1.49 lakh crore in Q3FY25, up from ₹1.41 lakh crore in the same quarter last year. The EBITDA for the O2C segment grew to ₹14,402 crore from ₹14,064 crore year-on-year, though the EBITDA margin declined slightly to 9.6% from 10%.

Shares of RIL closed at ₹1,276.45 on Friday, rising by ₹7.90 or 0.62% on the BSE.

Mukesh Ambani-led Reliance Industries’ acquisition of Nauyaan Tradings and Nauyaan Shipyard marks a strategic expansion into the shipbuilding and heavy engineering sector.

The Dahej shipyard’s facilities and manufacturing capabilities are expected to strengthen RIL’s position in the industry and drive future growth.